However, the landmark legislation still needs to clear some more hurdles before the bill becomes a law, enforceable by the April 1, 2017 deadline.

Here are some details about GST and its impact:

What is Goods and Services Tax (GST)?

It is a broad-based and comprehensive tax on manufacture, sale and consumption of goods and services at a national level.

What is the objective of GST?

To remove multiplicity of taxes across states to create a single national taxation system, as well as a single common market

How will it work?

GST is envisaged as a consumption tax, and hence the tax is passed on until the last stage, wherein the customer of the goods and services bears the tax.

What are some of the key inefficiencies of the current tax system?

The current tax system of CENVAT (central VAT) and state VAT (SVAT) suffers from multiple layers and a cascading burden of taxes. The state VAT provides for tax credit for intrastate transactions (within a state), but the present system is unable to provide tax credit for inter-state transactions.

How will GST help?

GST would subsume other forms of indirect taxation, making it easier for businesses to comply with the tax regime. Being a multi-stage tax, GST provides for an input tax credit mechanism (to claim set-offs for tax paid in the prior stages of production / distribution), which is expected to encourage better invoicing and voluntary compliance.

How does the government benefit?

The easier tax structure along with broader tax base (fewer exemptions, and taxing all goods & services) would help to increase revenue collections for the government.

How do corporates benefit?

Companies’ decisions to set up production operations would be influenced not by tax benefits but based on core business efficiency. Also, with the destination-based principle and provision to claim input tax credit, tax rate applicable on exports is likely to be zero, increasing the competiveness of Indian firms

What type of GST structure is likely to be implemented in India?

The nature of GST to be implemented is widely expected to be the Dual GST model with concurrent powers to both center and state to tax both goods and services over a common and identical base.

What is the standard GST rate likely to be?

The Chief Economic Advisor-led panel report has recommended the standard GST rate (which would be applied across all services not specifically specified) to be 17-18 percent

How is GST expected to impact inflation, growth and public finances?

Implementation of the GST in the near term could bring some uptick in inflation, but growth and public finances to be affected positively. Moreover, inflationary impact, if any, should be transitory.

Which sectors stand to lose, gain from the implementation of GST?

Consumption (warehousing consolidation), logistics (more movement of heavy vehicles), house building materials (lower duties), and industrial manufacturing would likely experience a positive impact; oil & gas could see a negative impact, while cigarettes could see a negative impact only if overall tax incidence goes up, which may be a low-probability event. The remaining sectors would likely see a neutral impact.

Read more at: http://www.moneycontrol.com/news/business/explained-what-gst-means-for-economy-corporatecommon-man_7171401.html?utm_source=ref_article

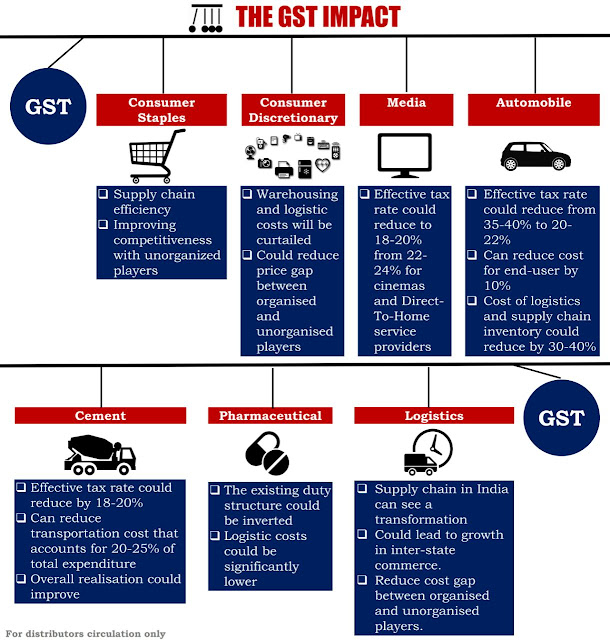

GST Impact on Sectors/Companies in a Nutshell

1) BANKS - Current service tax 15%..after GST 18% (Negative)

2) CONSUMER STAPLES - current tax rate 22%..after GST it's 18%.

POSITIVE for Asian paints, Dabur, HUL, EMAMI..NEGATIVE for ITC & UNITED BREWERIES..

3) CONSUMER DISCRETIONARY - current 15%..after GST 18%

NEGATIVE for Jubilant Food works, Coffee Day & Restaurant Businesses..

4) MEDIA - current Tax 15% service tax and 7% entertainment Tax by State.. After GST it will be 18%

POSITIVE for DISH TV, VIDEOCON D2H, BIG TV..

5) TELECOM - current Tax 15%, After GST 18% may see marginal dip in consumption as tax rises from 15% to 18%

6) AUTO INDUSTRIES - current Tax 27%.. after GST it will be 18%..

POSITIVE for M&M, MARUTI, BAJAJ AUTO, EICHER MOTORS, ASHOK LEYLAND..

7) METALS - current TAX 18% after GST 18% no major impact..

8) CEMENT - current Tax 27% altogether after GST it will be 18%

POSITIVE for Ultra tech cement, shree cement, ambuja cement etc..

9) PHARMA - current Tax 15% after GST it will be 18% .

NEGATIVE for Pharma companies..

10) REAL ESTATE - 15% to 16% Stamp duty so no major impact on REAL ESTATE companies.

11) LOGISTICS - major benefits to logistics sector no impact of GST

POSITIVE for - Container Corp, GATI etc...!

1) BANKS - Current service tax 15%..after GST 18% (Negative)

2) CONSUMER STAPLES - current tax rate 22%..after GST it's 18%.

POSITIVE for Asian paints, Dabur, HUL, EMAMI..NEGATIVE for ITC & UNITED BREWERIES..

3) CONSUMER DISCRETIONARY - current 15%..after GST 18%

NEGATIVE for Jubilant Food works, Coffee Day & Restaurant Businesses..

4) MEDIA - current Tax 15% service tax and 7% entertainment Tax by State.. After GST it will be 18%

POSITIVE for DISH TV, VIDEOCON D2H, BIG TV..

5) TELECOM - current Tax 15%, After GST 18% may see marginal dip in consumption as tax rises from 15% to 18%

6) AUTO INDUSTRIES - current Tax 27%.. after GST it will be 18%..

POSITIVE for M&M, MARUTI, BAJAJ AUTO, EICHER MOTORS, ASHOK LEYLAND..

7) METALS - current TAX 18% after GST 18% no major impact..

8) CEMENT - current Tax 27% altogether after GST it will be 18%

POSITIVE for Ultra tech cement, shree cement, ambuja cement etc..

9) PHARMA - current Tax 15% after GST it will be 18% .

NEGATIVE for Pharma companies..

10) REAL ESTATE - 15% to 16% Stamp duty so no major impact on REAL ESTATE companies.

11) LOGISTICS - major benefits to logistics sector no impact of GST

POSITIVE for - Container Corp, GATI etc...!